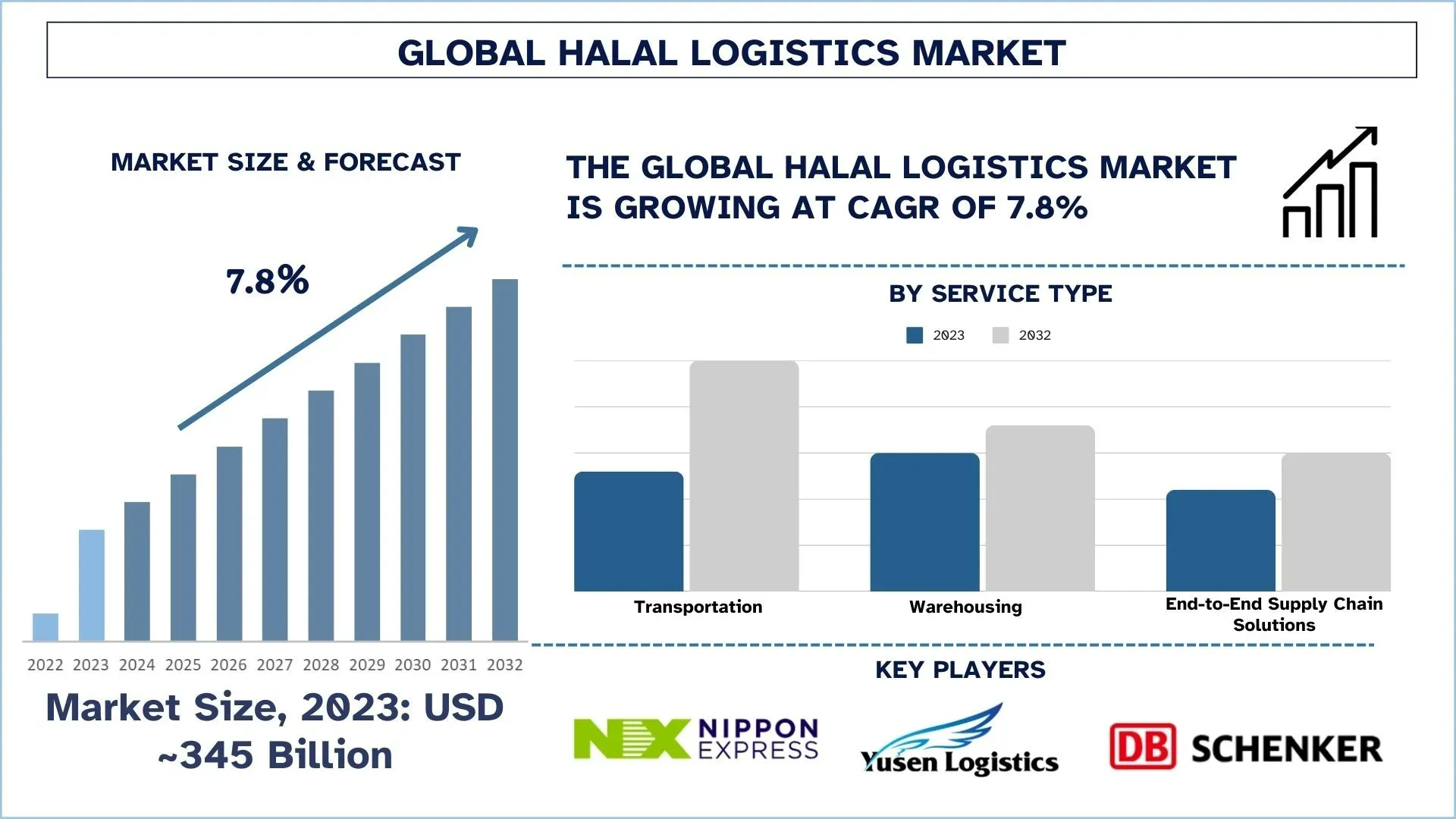

According to the UnivDatos Market Insights, rising global demand for halal products, stringent regulatory frameworks, growth in the halal food sector, expanding halal pharmaceuticals and cosmetics, rising e-commerce in Muslim-majority markets, and expanding Middle Eastern and Southeast Asian markets drive the Halal Logistics market. As per their “Halal Logistics Market” report, the global market was valued at USD 345 Billion in 2023, growing at a CAGR of about 7.8% during the forecast period from 2024 - 2032 to reach USD Billion by 2032.

For More Detailed Analysis in PDF Format, Visit- https://univdatos.com/reports/halal-logistics-market?popup=report-enquiry

Asia-Pacific: The Hub of Halal Logistics Growth

· Asia-Pacific alone is the largest and fastest-growing market for halal logistics because of the presence of the huge Muslim population in these countries of Indonesia, Malaysia, Thailand, and so on.

· Governments of these nations have adopted policies that embody strict halal compliance, this has presented logistical companies with a chance to create halal supply chains.

· Currently, Malaysia is the world’s largest certifier of halal logistics, and it has recently released the MS2400 Halal Logistics Standards describing how storage, transportation, and distribution of foodstuffs must comply with Islamic law.

· Some of the significant advancement seen in this region is the growth of certified warehouse and cold chain logistics, particularly the flow of cold-approved foods and medicines.

· Wearable devices, together with the application of blockchain and the Internet of Things (IoT), make the tracking processes more effective.

· Also, for accessing products from halal e-commerce marketplaces such as Indonesia, last-mile delivery services that offer the last halal certificate are in high demand.

· Especially with the high export of halal products, major logistics centers of Singapore and Malaysia are serving as the gateway to international markets for the products.

On 07 June 2023, Indonesia and Malaysia officially signed a cooperation on the recognition of halal certificates. The G-to-G synergy is marked by the Memorandum of Cooperation (MoC) between the Government of the Republic of Indonesia and the Government of Malaysia concerning mutual recognition of halal certificates for domestic products.

As per the International Trade Administration in 2022

Malaysia Halal Certification

In Malaysia, the medical device market is valued at over $1.4 billion. With more than 60 percent of the Malaysian population practicing Islam as their religion, Malaysia has developed a detailed halal certification for medical devices that meet requirements prescribed by the Islamic Sharia law. Companies that meet those Halal requirements may benefit from the growing market opportunity in the medical device sector.

To be considered Halal under the Malaysian system, products must be made from materials or ingredients allowed under Sharia law. For the Malaysian market, Halal certification must be issued by the Department of Islamic Development Malaysia (JAKIM). While it is not compulsory for all manufacturers who market their devices in Malaysia to get their devices Halal-certified, those medical devices with Halal certifications would be preferred over other non-certified products.

Middle East: Strengthening the Halal Supply Chain

· The region consists of some of the biggest halal markets, and it is, therefore, enhancing its investment in halal logistics facilities and networks.

· UAE, KSA, and Qatar, as well as other countries, also take the primary role in the process of harmonization of the halal logistics applicable at the international level.

· The UAE has initiated the ‘Dubai Islamic Economy Strategy’ with the vision of becoming a leader in the international Halal trade market.

Growing halal market

Dubai is also ideally placed to tap into the growing global halal industry, with the Dubai Chamber of Commerce and Industry (DCCI) predicting the global market for halal products and services will grow by 5.9% annually to reach US$300 billion by 2026.

The global halal economy alone is projected to hit US$2.4 trillion by 2024, according to the 2020/21 State of the Global Islamic Economy Report. According to the study, Muslim spend on food increased by 3.1% in 2019 from $1.13 trillion to $1.17 trillion, and is expected to drop slightly in 2020 as a result of the Covid-19 pandemic, before growing to reach $1.38 trillion in 2024 at a 5-year CAGR of 3.5%.

· Number one significant advancement has been seen in the location of halal logistics in the FTA, which includes the Halal Trade and Marketing Centre in Dubai.

· It is also observed that CML serves customers in this region more efficiently through Halal-certified cold chain logistic services that maintain the Halal food and pharmaceutical products.

· As cross–border trading continues to grow, Middle Eastern countries are improving their supply relations with Europe, Africa, and Asia, hence enhancing exportation.

· Saudi Arabia’s recently imposed regulation on Halal certification for food imports has increased the demand for Halal-acceptable logistics services.

· With the help of smart warehousing and RFID tracking, it is possible to control compliance with all the regulations of halal integrity along the logistic chains in the region.

Europe: A Growing Market for Halal Logistics

· Europe’s Halal logistics market is expanding as Europe has a permanently increasing Muslim population and consumers’ awareness of the Halal certification.

· Thus, countries of interest like France, Germany, and the UK experience higher investment demand in halal supply chain solutions.

· One of the production trends in Europe is the incorporation of the halal logistic system into the current logistic networks.

· For businesses aiming to obtain Halal certification in Europe, it's essential to engage with recognized certification bodies that can guide them through the process. These are

o Halal Certification Europe (HCE)

o European Certification Centre for Halal (ECC Halal)

o Department of Halal Certification Europe (DHCE)

o European Register of Halal Certifications (ERHC)

· The EU is urging the member countries to adopt a common framework for halal certifications to enhance the ease of trade across the member countries in the region.

· This is because there is growing e-commerce in the market, and online halal grocery requires halal-certified logistics services.

· This has extended the demand for halal logistics in catering to hotels, airline services, and other hospitality facilities, thereby improving the growth of the market.

The main factors that are rallying for the progress of halal logistics in these regions include:

· Certainly, regulations and certifications are still another factor; we see governments from all three regions tightening their expectations about halal compliance up; thus, halal logistics is part of the supply chain.

· E-business and Digital Connectivity – The availability of online Halal Bazaar is catalyzing the need for delivering Halal Logistics solutions with unique product traceability and certifications.

· Blockchain and IoT Adoption – today's tracking technologies guarantee non-tampering with the product and prevent cross-and-taint with others.

· Cold Chain Logistics – Temperature-controlled storage as well as transportation are gradually becoming the new norms for the Halal foods and medicine market.

· Global Market Liberalization – The markets are opening up for easier trading of halal food by entering into various agreements with each other country.

Explore the Comprehensive Research Overview - https://univdatos.com/reports/halal-logistics-market

Related Reports:

Halal Tourism Market: Current Analysis and Forecast (2024-2032)

Halal Ingredients Market: Current Analysis and Forecast (2022-2028)

Reverse Logistics Market: Current Analysis and Forecast (2022-2028)

Hazardous Goods Logistics Market: Current Analysis and Forecast (2022-2028)

Conclusion

· The halal logistics market has observed an outstanding increase in Asia-Pacific, Middle East, and Europe due to the increased demand for certified products, adoption of new technologies, and government support.

· The Asia-Pacific region is the leader in terms of regulatory contributions and exports, while the Middle Eastern nations aim to develop infrastructure and free zones for halal industries, and Halal e-commerce and accreditation are found to be on the rise in Europe.

· There are Certain advancements, such as technological advancement, required in this field to enable organizations to take advantage of the new trends and the changes in the laws governing business operations to operate in this new and progressing market segment.

Contact Us:

UnivDatos

Contact Number - +19787330253

Email - contact@univdatos.com

Website - www.univdatos.com