A crypto derivatives exchange is a platform where traders can buy and sell derivative contracts linked to cryptocurrencies, such as Bitcoin or Ethereum. These contracts derive their value from the underlying crypto asset, enabling traders to profit without owning the actual cryptocurrency. Here are the key features of a crypto derivatives exchange:

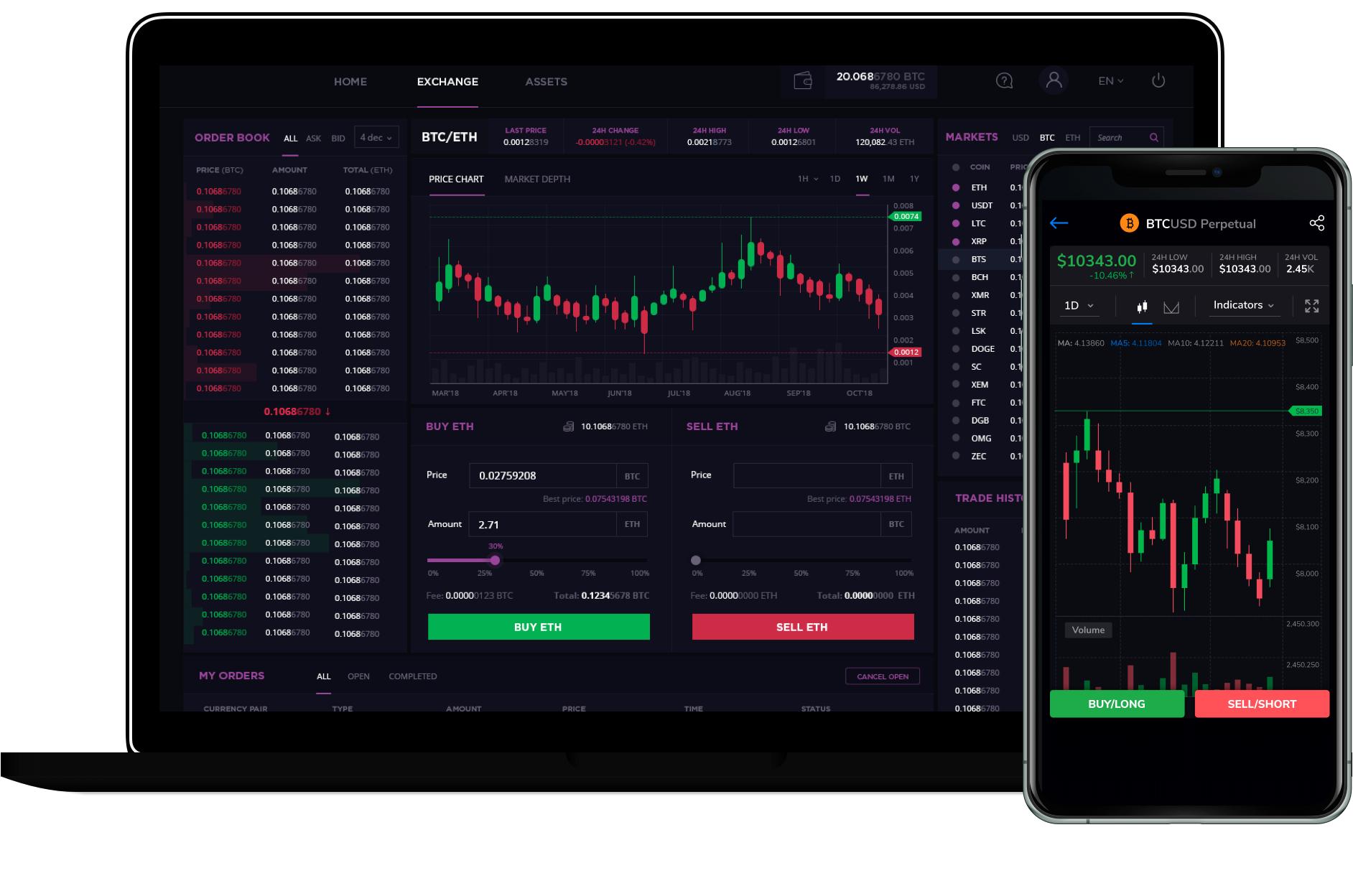

- Leverage Trading

One standout feature is leverage, allowing traders to amplify their position sizes with borrowed funds. This can lead to higher profits but also increases risks.

- Variety of Contracts

Most exchanges offer different types of derivative contracts, including futures, options, and perpetual contracts, catering to diverse trading strategies.

- Risk Management Tools

Features like stop-loss orders, take-profit orders, and margin calls help traders manage risk effectively in volatile markets.

- High Liquidity

Top exchanges ensure a deep order book, enabling users to execute trades quickly and at fair prices.

- Robust Security

Reputable exchanges prioritize security through multi-signature wallets, two-factor authentication, and cold storage for funds.

- Advanced Trading Tools

Charting tools, real-time data, and analytics empower users to make informed trading decisions.

These features make crypto derivatives exchanges a crucial tool for traders seeking flexibility and opportunities in the cryptocurrency market.